Supreme Court Rules 5-4 States Can Collect Sales Tax on Online Sales From Out-of-State Retailers

On June 21, 2018 in a 5-4 Ruling, the United States Supreme Court opened the door for states to require sales tax on internet sales by out-of-state retailers.

Sales to out of state customers have been tax exempt for over 50 years. A 1967 ruling decided that mail-order companies did not have to collect sales tax from customers that did not reside in the state.

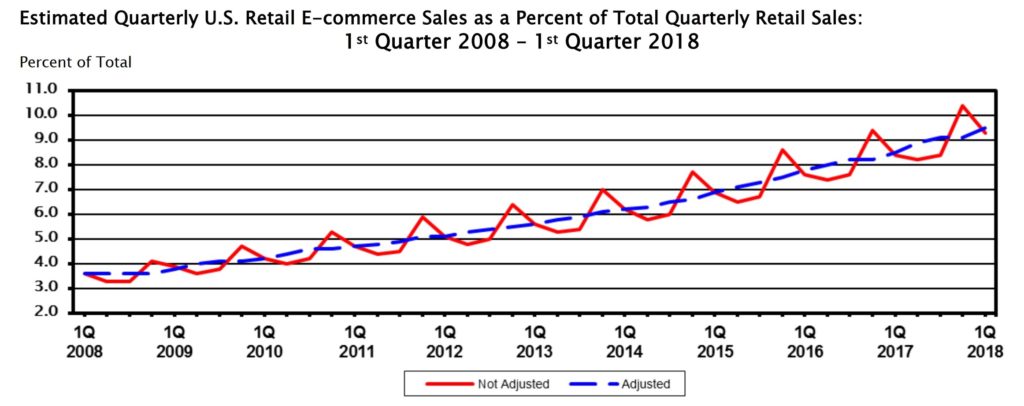

In recent years, the internet has made sales across state lines easier than ever. E-Commerce sales have grown to represent nearly 10 percent of all sales. Online sales have been replacing brick and mortar sales for years now, resulting in dwindling sales tax revenue for the states.

This Supreme Court ruling opens the door for states to require sales tax on all transactions, whether they occur in a physical store, or online…and you can expect most states to do just that, if it stands.

In the first quarter of 2018 E-commerce sales increased to 123.7 billion, a 16.7% over the same quarter in 2017, which accounted for 9.5% of total sales according to the U.S. Census.

The ‘Internet Tax’ is Good News for States

U.S. state and local government tax revenue rose to $350.2 billion in the first quarter of 2018, a 5.8% increase from the prior year (2017), the U.S. Census Bureau reported in June 2018.

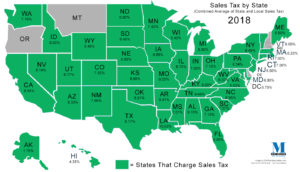

Sales tax is one of the largest sources of revenue for the 45 states (and the District of Columbia) that collect sales tax, 38 of which also allow local sales tax.

Click to view sales tax rates by state.

States will undoubtedly enjoy an increase in sales tax revenue after this Supreme Court ruling.

What the Internet Tax Means to Your Retail Businesses

If you sell taxable goods online or in a store, you will now be required to collect and pay sales tax. (There are additional categories that this could impact, but we’re keeping this simple).

Large retailers who have historically had more sales in stores than online, and the states may be celebrating, but small business owners may not be happy about how this ruling will impact their retail business.

Brick-and-mortar chains have been seeking what they view as a loophole to be closed, to “level the playing field”, so they can better compete with online retail giants like Amazon. The states are the ultimate winners because this ruling makes eCommerce sales eligible for sales tax, even if the seller has no physical presence in the state, unlike previous law.

Every online retailer, no matter how small, must now register, collect, file and pay sales tax to states across approximately 10,000 sales tax jurisdictions across the United States. Third-party merchants that sell on marketplaces like Amazon, Walmart, eBay, Best Buy, etc. are also currently required to pay sales tax in two states: Pennsylvania and Washington. The Supreme Court ruling could make taxing transactions of third-party merchants more likely to become the norm.

Sales tax could prove to be a daunting task for small online businesses. You can count on the states to be aggressive in pursuing businesses who fail to pay sales tax.

Software embedded in sales tax platforms may help with the calculation of sales tax, but there are several steps, such as compliance and service-related transactions that create gray areas that even large businesses have difficulty understanding.

What Happens If You Don’t Pay Sales Tax?

Compliance with sales tax law is one of the easiest ways to preserve capital and keep the tax authorities out of your business.

Non-compliance with tax law of any kind can be very risky, and extremely expensive. States are aggressive in collecting sales tax and will not hesitate to impose penalty and interest when they have discovered tax had not been properly collected and paid to the state…even years after the fact.

Businesses across the U.S. in a variety of industries have been forced to close over sales tax issues…many online businesses may struggle to keep track of, and comply with, new sales tax laws in each state they have customers.

When Will My State Require Sales Tax on Internet Sales?

When will your state roll out new sales tax law?

Now that the Supreme Court has cleared the way, expect states across the U.S. to begin to roll out new tax law to take full advantage of this ruling. Justice Anthony Kennedy noted that the law could face legal challenges. The states have had plenty of time to prepare, and the states are not in the habit of turning down revenue, so new tax law is likely forthcoming in all states that charge sales tax.

Comments are closed.