SALT Reverse Audits – Sales & Use Tax Recovery Services

The amount of taxes erroneously overpaid by US businesses and not-for-profits is nothing short of astounding. There are numerous firms that provide Reverse Audit services.

What is a Reverse Audit?

A Reverse Audit is a non-obtrusive audit, similar to those conducted by the Sales and Tax Department of each State with one exception. Our sole focus is to identify sales and use tax credits, over-payments, opinions and policies that favor YOUR organization.

Best Reverse Audit Sales Tax Refund Company is One That is Honest and Lets You Keep Most of Your Refund

This sounds like common sense. However, it is not uncommon for SALT companies performing sales and use tax refund and credit audits take up to 75% of recovered sales tax refunds and credits.

We believe it should be the industry standard for the sales tax reverse audit company performing the Reverse Audit, do the work, take all the risk, and only get paid a contingency fee when the refund or credit is approved. But not every reverse audit company agrees.

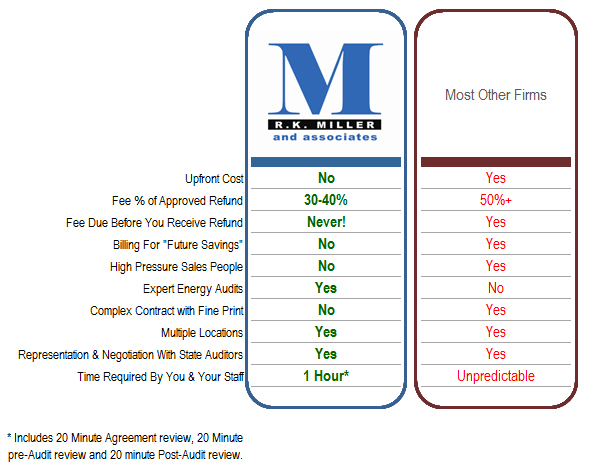

Compare Reverse Audit Company Fee Structures:

(click on graphic for larger view)

We do conduct Reverse Audits under a contingency fee agreement, and we only get paid that fee (no surprises) when the state approves your refund (or credit), no matter how long it takes…even if we’ve had to go to the first level of appeals to get it.

Our contingency fee varies by type and size of the organization and typically ranges from 30-40% for a first-time client. Our contingency fee is lower for returning clients.

*We can’t stress the importance of regular Reverse Audits enough!

It is important to repeat the Reverse Audits every couple of years to avoid losing refunds to statute of limitations.

Contact us today for a custom quote!

How do you choose the best reverse sales tax audit company?

Compare Reverse Refund Services

Our SALT (Sales and Use Tax) Recovery Services focus on the identification of overpaid taxes or overlooked credits that our clients never knew they were entitled to, or overlooked (every had a C.P.A., in-house SALT sales tax department, finance team and/or accountants).

We identify overpaid sales tax that is then credited or refunded to the tax payer through what is frequently called a “Reverse Audit“. We also make recommendations on how to avoid future over-payments and promote compliance to reduce risk of exposure for additional tax, – And, do NOT charge for this important information, unlike our competitors.

Few, approach the process the way RK Miller Associates does.

We view ourselves as Tax Payer Advocates, helping businesses achieve fair results through aggressive, yet ethical interpret, application and negotiation with the State Sales Tax authorities.

Our relationship with our clients is built on trust.

RK Miller Associates Reverse Audit Creed:

- We apply the expertise of a former State Sales Tax Auditor to represent our client’s interests.

- We thoroughly understand Sales Tax law.

- We are often able to leverage little-known or obscure Sales and Use SALT tax opinions and policies that put the tax law on the side of the tax payer.

- We never charge a fee unless we find money (credit or refund) for our client. You pay us upon official notification of a credit, or receipt of a refund check from the State, whichever applies.

- Our fees, only due when we are successful, are lower than most SALT firms, allowing our clients to keep more of monies recovered.

- We never charge for “future savings”.

- We take responsibility for all communication and negotiation with the State Sales Tax office.

- We conduct all communication on behalf of our clients.

- We will see the claim through the first-level of appeals, including all mediation, meetings, correspondence, and negotiation with Sales Tax Department representatives.

- Our agreements are simple, no fine print or surprises.

- We don’t use aggressive sales people to wear you down. We are 100% confident in our abilities and although we cannot imagine why you wouldn’t want to engage us, we will not hound you incessantly if you decide not to work with us.

- We confidently pursue what our clients are entitled to by law and respectfully engage with Sales Tax Department representatives throughout every step of the process.

- Our approach is highly aggressive, yet ethical and professional. We respect the roles and responsibilities of all parties, but know how to get the job done.

- We report to you every step of the way, so you know where you stand, at all times in the process.

- We represent you (and will explain why we highly recommend this approach) in all negotiations and meetings.

- We never give up. There are times when we must strongly advocate for our clients, especially when it comes to large sums of money. We will fervently pursue credits and refunds, even when it takes weeks, months or many months to get achieve the best possible outcome.

Why Your Sales Tax Audit Didn’t Reveal What We Find in Reverse Audits

Simply put, the State Sales Tax Audit is one-sided. SALT audits are designed to identify Sales and Use tax owed to the state. Auditors are not required to, therefore seldom, if ever, consider or apply tax laws, opinions or policies that favor the tax payer.

Why Should You Hire an Outside Company for a Reverse Audit?

SALT laws and opinions are continually changing, impacting the true sales and use tax liability of our clients. Our Tax experts are well-versed in New York Tax law (and tax law of over 30 states), opinions and policies that Accountants and CPA’s are unaware of.

R.K. Miller & Associates has a 100% Success Rate with Recovery clients. EVERY client has had an accountant and/or CPA on staff that was not taking advantage of critical exemptions. Our services have resulted in the recovery of tax dollars erroneously paid by New York State businesses and non-profit organizations.

Our Tax Recovery Services are meant to supplement the efforts of your Accountants and CPA’s.

We welcome the opportunity to pursue any money owed to you. You will receive professional, courteous and efficient service…and most likely money you did not even know was due you.

Zero Risk, Zero Cost unless we are successful.

You have nothing to lose and everything to gain.

Preserve Capital.

Increase Profits.

Please contact us with any questions you might have or call for a Free Consultation to discover how we may be able to help you.

We Help Not-for-Profits Too!

Many non profit organizations and businesses in the State of New York

have erroneously overpaid taxes or missed exemptions unique to their organization. Our service is invaluable in tough economic times when donations and fundraising is down.

The amount of tax erroneously paid is staggering…and millions default to the state.

If presering capital and increasing profits is important to you, Schedule your Free Initial Consultation today!

Comments are closed.