Reverse Audit Company Secures Sales Tax Refunds With Zero-Risk Guarantee

Why Should You Hire a Reverse Audit Company?

95% of Businesses overpay tax. (Forbes 2018). Every year, businesses relinquish BILLIONS of dollars to state tax authorities they DO NOT OWE.

How do we know?

President and Founder of RK Miller Associates, Robert Miller, saw this first hand when he worked as a sales tax auditor for New York State. The amount of overpaid tax was staggering. He started RK Miller Associates to represent business owners and organizations to help them keep more of their capital and be more profitable.

What is a Reverse Audit?

A Reverse Audit is a method used to identify overpaid tax and secure a refund or credit.

A Reverse Audit is the opposite of audits performed by the Tax and Revenue Departments of states across the United States.

Unlike a Sales Tax Audit, conducted by the tax authority of a state that identifies unpaid sales and use tax (which often comes with penalties and interest), a Reverse Audit Company identifies overpaid sales and use tax, as well as exemptions that can result in either a refund or credit owed to your organization.

Approximately 80% of businesses overpay sales and use tax and never know it. As a result, state tax authorities keep BILLIONS of dollars every year that was overpaid and never claimed.

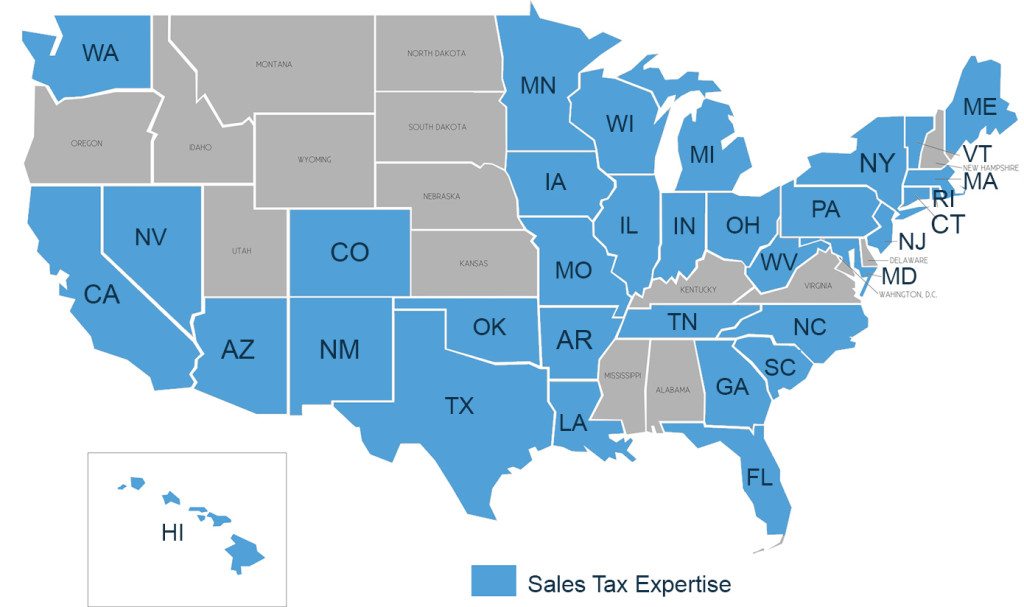

If you conduct taxable transactions from, or sell to, customers and clients in the United States indicated in blue in the map below, your organization could be eligible for a Reverse Audit.

One of the most established Sales and Use Tax – Reverse Audit companies in the U.S.

RK Miller Associates have recovered millions of dollars in Reverse Audits for clients who would have otherwise lost their refund or credit because they were unaware they were overpaying tax. Our sales tax experts have conducted reverse audits in states across the U.S. for organizations of all sizes from a variety of industries; from large manufacturers, pharmaceutical companies, hospitality companies, hotel, software, luxury goods, and many more.

We help organizations improved their capital positions and reduced tax liability with our Zero Risk Reverse Audit.

Zero Risk means that if we do not recover capital in the form of a refund or credit for your organization, you pay NOTHING for our services. We Guarantee it!

Our Sales and Use Tax Reverse Audit Guarantee applies to our Reverse Audit Service, for which we have a 100% success rate in retrieving sales and tax refunds or credits for our clients.

Our Sales and Use Tax Reverse Audit Guarantee applies to our Reverse Audit Service, for which we have a 100% success rate in retrieving sales and tax refunds or credits for our clients.

Sales and Use Tax Company

We have a 100% Success Rate!

Zero Risk. No gimmicks.

We have recovered millions of dollars

in overpaid sales and use tax refunds and credit

that organizations had no idea

they were entitled to.

Could a Reverse Audit Restore Capital and Increase Profitability of Your Organization?

Most businesses have an

accountant and/or CPA, finance department, CFO, and/or tax attorney.

Click to learn why 95% of businesses STILL overpay tax.

We have obtained millions of dollars in credit or refund for our clients over the years. What do these organizations have in common?

- Most businesses do not know they are overpaying tax.

- They don’t know about vital exemptions.

- They aren’t familiar with tax law that could significantly reduce their tax liability.

- They don’t know that Hundreds of Millions of dollars of overpaid tax are returned to businesses every year via Reverse Audits.

(is your business or not-for-profit one of them?)

- They had no idea their business contributed to the BILLIONS of dollars overpaid sales and use tax never returned to taxpayers because they had no idea they were owed a refund or credit.

Over the years, our services have resulted in the recovery or preservation of millions of dollars in sales tax to businesses and non-profit organizations, operating in over 30+ states across the United States.

SALES AND USE TAX IS OUR SPECIALTY

We uncover tax refunds and credits due to specific nuances

in Sales Tax Law that most Accountants, CPA’s, Tax Attorneys, internal Sales Tax and Finance Departments are unaware of, or overlook.

Our services are meant to supplement the efforts of your Accountants and CPA’s.

Reverse Audits require an in-depth understanding of the tax laws.

We frequently surprise our clients when they learn just how much was owed them!

Let us help you get any refund or credit your organization is owed.

You will receive professional, courteous and efficient service…and, most likely, recovered capital you did not even know you were entitled to!

Visit our Reverse Audit FAQs Page

Contact Us today to see if your organization is a good candidate for a Reverse Audit.

Not every organization is a candidate for a Reverse Audit, and not every audit results in filing of a refund claim. Results of past clients are not indicative of what you should expect, every organization is different.